- 1 회귀분석 기초

- 2 인과 관계 성립 조건

- 3 변수변환(Box-Cox변환)

- 4 단순회귀분석

- 5 중회귀분석

- 6 변수선택

- 7 더미변수

- 8 교호작용

- 9 다중공선성(multicollinearity)

- 10 회귀진단

- 11 두 회귀식의 비교

- 12 다변량 회귀분석

- 13 결과의 해석

- 14 표준화된 회귀계수(beta)

- 15 predict

- 16 마우스로 콕콕 찝어서 이상치 제거 후 회귀분석하기

- 17 coef의 신뢰구간

- 18 confidence, prediction level

- 19 R-squared

- 20 Adjusted R-squared

- 21 as.lm.nls

- 22 비모수 방법

- 23 오차 계산

- 24 t-sql로 구현한 단순회귀분석

- 25 Two-Stage Least Squares

- 26 참고자료

[edit]

1 회귀분석 기초 #

- '회귀(regression)' 개념은 19세기 말 영국의 생물통계학자 골튼(F.Galton)에 의해 처음 이용됨.

- 평균으로의 회귀.

- 변수 사이의 함수적 관계를 나타내는 수학적 회귀방정식을 구하고 독립변수를 특정한 값에 따른 종속변수의 값을 예측하는 기법

- 회귀분석은 서로 영향을 주고 받으면서 변화하는 인과관계를 갖는 두 변수 사이의 관계를 분석

- 산포도를 그려보면 회귀분석을 할 것인지 말 것인지 대략 결정할 수 있다. (양/음의 상관관계)

- 현상의 정량적 이해나 Y의 예측을 위하여 유효한 회귀 모델을 구축하는 것이 회귀분석의 주목적.

- 잔차(residual)분석: 모델검증

- 회귀진단: 특이한 이상치나 모수의 추정에 큰 영향을 주는 관측치 검출

- 목적변수가 양적변수일때 적용 가능

- 설명변수는 양적이거나 질적이거나 상관없으나, 질적변수는 데이터의 값이 0 또는 1만 취하는 더미변수를 도입하여 질적인 데이터를 변환해야 한다.

- 종속변수(y)는 정규분포라 가정

- 회귀식과 표준편차

- y = a + bx ± 1σ : 68.0%가 이 구간내에 들어온다.

- y = a + bx ± 2σ : 95.5%가 이 구간내에 들어온다.

- y = a + bx ± 3σ : 99.7%가 이 구간내에 들어온다.

- y = a + bx ± 1σ : 68.0%가 이 구간내에 들어온다.

[edit]

2 인과 관계 성립 조건 #

- 종속 변수와 독립 변수간에 상관 관계가 있어야 한다. (독립 변수가 변하면 종속 변수도 변해야 함)

- 독립 변수가 종속 변수보다 먼저 존재해야 한다. (시간의 우선성)

- 종속 변수와 독립 변수간의 상관 관계가 제3의 변수로 설명될 여지가 없어야 한다. (제3의 변수가 종속 변수를 설명해서는 안 된다)

[edit]

3 변수변환(Box-Cox변환) #

사용법은 다음과 같다.

library("TeachingDemos")

y <- rlnorm(500, 3, 2)

par(mfrow=c(2,2))

qqnorm(y)

qqnorm(bct(y,1/2))

qqnorm(bct(y,0))

hist(bct(y,0))

library("car")

y <- rlnorm(500, 3, 2)

hist(box.cox(y,0))

[edit]

4 단순회귀분석 #

근속년수와 연봉의 회귀분석

#x: 근속년수 x <- c(2,3,4,6,8,9,10,12,13,15,17,19,20,23,25,26,27,29,30,33) #y: 연봉 y <- c(1500,1640,1950,2700,2580,3200,3750,2960,4200,3960,4310,3990,4010,4560,4800,5300,5050,5450,5950,5650) result <- lm(y~x) summary(result)

결과

Call:

lm(formula = y ~ x)

Residuals:

Min 1Q Median 3Q Max

-470.0 -290.8 -168.0 293.9 789.4

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1708.117 173.489 9.846 1.13e-08 ***

x 130.960 9.089 14.409 2.52e-11 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 386.6 on 18 degrees of freedom

Multiple R-squared: 0.9202, Adjusted R-squared: 0.9158

F-statistic: 207.6 on 1 and 18 DF, p-value: 2.522e-11

결과해석

- 회귀식: y = 130.960 * x + 1708.117

- 자유도: 18

- 결정계수(coefficient of determination): 0.9202(조정된 결정계수: 0.9158)는 이 모델이 92%를 설명함을 뜻함.

- Pr(>|t|) : F검정의 결과 (p-value) = 2.52e-11

- 귀무가설: 회귀식에 의미가 없다.

- 대립가설: 회귀식에 의미가 있다.

- p-value = 2.522e-11이므로 유의수준 0.05에서 대립가설 채택할 근거 있다. 즉, 회귀식에 의미가 있다.

- 귀무가설: 회귀식에 의미가 없다.

- 잔차분석

- 더빈 왓슨비(durbin-watson ration; 오차항간의 계열상관 유무조사)

- 바트렛의 검정(bartlett's test; 오차항의 분산의 균일성 조사)

- 잔차: Residual standard error: 386.6

- 더빈 왓슨비(durbin-watson ration; 오차항간의 계열상관 유무조사)

- 근속년수가 50년인 사람의 연봉은? 130.960 * 50 + 1708.117 = 8256.117 만원이다.

- 회귀식에 대입해서 잔차/표준편차 = 표준잔차, -2.5 <= 표준잔차 <= 2.5 면 정상치, 범위를 벗어나면 이상치일 가능성이 높다.

[edit]

5 중회귀분석 #

공던지기 결과과 악력, 신장, 체중의 중회귀분석

데이터

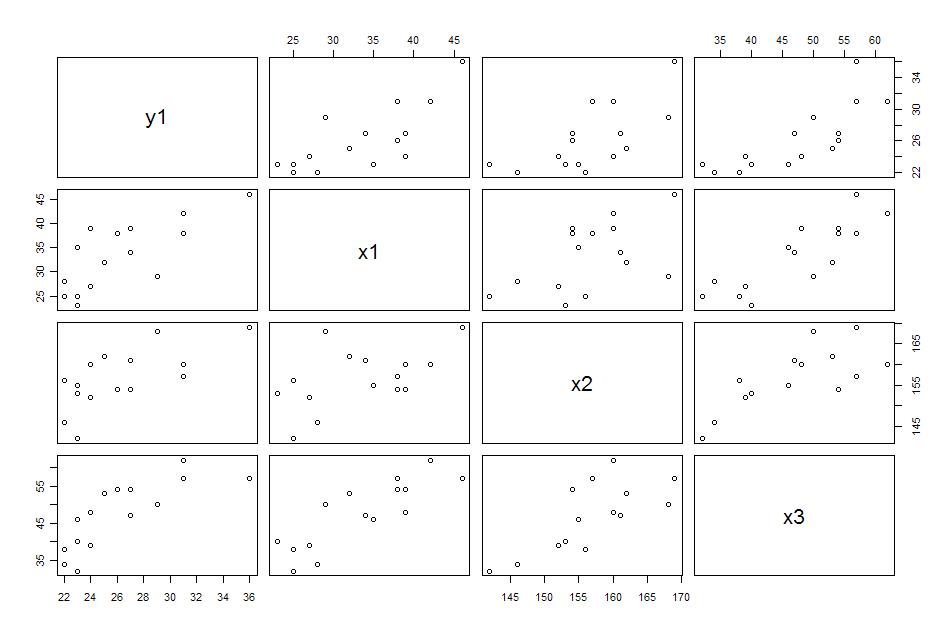

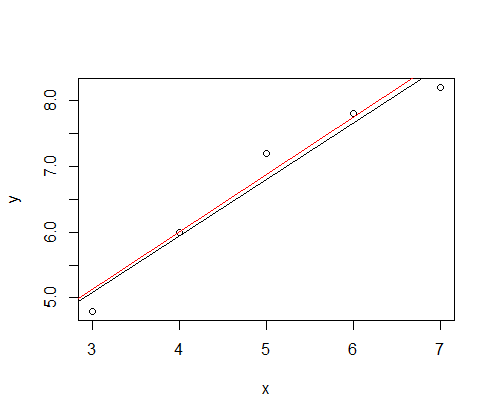

#x1:악력, x2:신장, x3:체중, y1:공던지기 x1 <- c(28,46,39,25,34,29,38,23,42,27,35,39,38,32,25) x2 <- c(146,169,160,156,161,168,154,153,160,152,155,154,157,162,142) x3 <- c(34,57,48,38,47,50,54,40,62,39,46,54,57,53,32) y1 <- c(22,36,24,22,27,29,26,23,31,24,23,27,31,25,23) data <- data.frame(y1,x1,x2,x3)

상관분석

#시각적인 관찰(산포도)이 필요하면 pairs(data)하면 된다.

cov.wt(data, cor=T)

> cov.wt(data, cor=T)

$cov

y1 x1 x2 x3

y1 16.31429 21.07143 20.01429 28.91429

x1 21.07143 48.66667 26.71429 53.64286

x2 20.01429 26.71429 52.25714 45.60000

x3 28.91429 53.64286 45.60000 82.54286

$center

y1 x1 x2 x3

26.20000 33.33333 156.60000 47.40000

$n.obs

[1] 15

$cor

y1 x1 x2 x3

y1 1.0000000 0.7478150 0.6854618 0.7879319

x1 0.7478150 1.0000000 0.5297304 0.8463624

x2 0.6854618 0.5297304 1.0000000 0.6943082

x3 0.7879319 0.8463624 0.6943082 1.0000000

>

결과해석- x1(악력)과 x3(체중)의 상관계수가 가장 높다. 0.8463624

- x1(악력)과 x2(신장)의 상관계수가 가장 낮다. 0.5297304

- 공던지기(y1)와 상관계수가 높은 순서는 체중(x3), 악력(x1), 신장(x2)의 순이다.

회귀분석

summary(lm(y1~x1+x2+x3))

> summary(lm(y1~x1+x2+x3))

Call:

lm(formula = y1 ~ x1 + x2 + x3)

Residuals:

Min 1Q Median 3Q Max

-3.9976 -1.3822 0.3611 1.1549 3.9291

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -13.2173 17.6038 -0.751 0.469

x1 0.2014 0.1842 1.093 0.298

x2 0.1710 0.1316 1.300 0.220

x3 0.1249 0.1667 0.750 0.469

Residual standard error: 2.532 on 11 degrees of freedom

Multiple R-squared: 0.6913, Adjusted R-squared: 0.6072

F-statistic: 8.213 on 3 and 11 DF, p-value: 0.003774

>

결과해석- 결정계수: 0.6913 (조정: 0.6072), 회귀식은 약 69%를 설명함.

- p-value: 0.003774으로 유의수준 0.05에서 대립가설을 채택. 즉, 회귀식은 유의함.

- 회귀식: y1 = -13.2173 + x1 * 0.2014 + x2 * 0.1710 + x3 * 0.1249

- Pr(>|t|)가 모두 0.05를 넘는 수준이다. 별로 안 좋다.

- 목적변수에 대한 각 설명변수의 영향력(t)

- 악력(x1) = 1.093

- 신장(x2) = 1.300

- 체중(x3) = 0.750

- 신장이 공던지기(y1)에 가장 많은 영향력을 끼치고 있다.

- 악력(x1) = 1.093

- 편회귀계수의 유의성 판정(F)

- 악력(x1) = 0.298

- 신장(x2) = 0.220

- 체중(x3) = 0.469

- 모두 0.05를 넘는다. 다중공선성을 의심해야 한다. 교호작용이 있는지도 봐야 한다.

- 악력(x1) = 0.298

[edit]

6 변수선택 #

- 변수를 잘못 선택하면?

- 추정의 정밀도가 나빠진다.

- y의 예측치는 편의를 갖게되고, 오차분산의 추정치는 과대평가하게 된다.

- 다중공선성(multicollinearity)의 문제 발생

- 추정의 정밀도가 나빠진다.

- 변수선택방법

- 전진선택(forward selection)

- 후진소거(backward elimination)

- 둘다(전진선택, 후진소거)

- 전진선택(forward selection)

- 이는 로지스틱 회귀분석의

![[http]](/moniwiki/imgs/http.png) 여기에 사용법이 기술되어 있다.

여기에 사용법이 기술되어 있다.

library("MASS")

fit <- lm(y1~x1+x2+x3,data=mydata)

step <- stepAIC(fit, direction="both")

step$anova # display results

[edit]

7 더미변수 #

- 만약 성별, 요일과 같은 변수가 회귀식에 포함되어야 하면 더미변수를 추가해야 함.

- p종류의 범주가 있으면 p-1개의 더미변수가 필요함.

- 성별은 2가지라 0, 1로 그냥 세팅하면 되지만 요일은 다음과 같이 해야 함.

- y = x + x1 + x2 + x3 + x4 + x5 + x6

x1 x2 x3 x4 x5 x6 월 0 0 0 0 0 0 화 1 0 0 0 0 0 수 0 1 0 0 0 0 목 0 0 1 0 0 0 금 0 0 0 1 0 0 토 0 0 0 0 1 0 일 0 0 0 0 0 1

[edit]

8 교호작용 #

가끔씩 두 개 이상의 변수 짬뽕으로 결과에 영향을 끼치는 경우가 있다.

교호작용이 없는 모델

m1 <- lm(formula=Height~Girth + Volume, data=trees) summary(m1)

> summary(m1)

Call:

lm(formula = Height ~ Girth + Volume, data = trees)

Residuals:

Min 1Q Median 3Q Max

-9.7855 -3.3649 0.5683 2.3747 11.6910

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 83.2958 9.0866 9.167 6.33e-10 ***

Girth -1.8615 1.1567 -1.609 0.1188

Volume 0.5756 0.2208 2.607 0.0145 *

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 5.056 on 28 degrees of freedom

Multiple R-squared: 0.4123, Adjusted R-squared: 0.3703

F-statistic: 9.82 on 2 and 28 DF, p-value: 0.0005868

교호작용이 있는 모델

m2 <- lm(formula=Height~Girth + Volume + Girth:Volume, data=trees) summary(m2)

> summary(m2)

Call:

lm(formula = Height ~ Girth + Volume + Girth:Volume, data = trees)

Residuals:

Min 1Q Median 3Q Max

-6.7781 -3.5574 -0.1512 2.3631 10.5879

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 75.40148 8.49147 8.880 1.7e-09 ***

Girth -2.29632 1.03601 -2.217 0.035270 *

Volume 1.86095 0.47932 3.882 0.000604 ***

Girth:Volume -0.05608 0.01909 -2.938 0.006689 **

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 4.482 on 27 degrees of freedom

Multiple R-squared: 0.5546, Adjusted R-squared: 0.5051

F-statistic: 11.21 on 3 and 27 DF, p-value: 5.898e-05

두 변수의 교호작용은 곱하기(Girth*trees)다. 아래의 A, B의 결과는 같다.

A

fitted(m2)

B

coef(m2)[1] + coef(m2)[2]*trees$Girth + coef(m2)[3]*trees$Volume + coef(m2)[4]*trees$Girth*trees$Volume

[edit]

9 다중공선성(multicollinearity) #

- 설명변수 사이에 선형관계가 두 개 이상 있을 때 다중공선성이 있다고 말한다.

- 상관분석(R함수: cov.wt())해서 상관계수가 1에 가까운 설명변수를 버린다.

- 다중공선성 진단

- 설명변수 x1, x2, x3, x4가 있을 경우

- x1 ~ x2 + x3 + x4 -> 상관계수 R1 -> 허용도(tolerance) = 1 - R1^2

- x2 ~ x1 + x3 + x4 -> 상관계수 R2 -> 허용도(tolerance) = 1 - R2^2

- x3 ~ x1 + x2 + x4 -> 상관계수 R3 -> 허용도(tolerance) = 1 - R3^2

- x4 ~ x1 + x2 + x3 -> 상관계수 R4 -> 허용도(tolerance) = 1 - R4^2

- (1 - Rj^2) = 허용도가 작을 때는 Rj가 1에 가까우므로 xj는 다른 설명변수의 선형결합으로 표현할 수 있다.

- 분산팽창계수(VIF: variance inflation factor) = 1 / (1 - Ri^2)가 10보다 크면 다중공선성이 존재한다고 경험적으로 판단함.

- VIP = 1 / (1 - Rj^2) = 1 / (1 - 0.7432^2) = 2.233869

- 설명변수 x1, x2, x3, x4가 있을 경우

#install.packages("Design",dependencies=T)

library("Design")

result <- lm(y1~x1+x2+x3)

vif(result)

> library("Design")

요구된 패키지 Hmisc를 로드중입니다

다음의 패키지를 첨가합니다: 'Hmisc'

The following object(s) are masked from package:base :

format.pval,

round.POSIXt,

trunc.POSIXt,

units

요구된 패키지 survival를 로드중입니다

요구된 패키지 splines를 로드중입니다

다음의 패키지를 첨가합니다: 'survival'

The following object(s) are masked from package:Hmisc :

untangle.specials

Design library by Frank E Harrell Jr

Type library(help='Design'), ?Overview, or ?Design.Overview')

to see overall documentation.

다음의 패키지를 첨가합니다: 'Design'

The following object(s) are masked from package:survival :

Surv,

survfit

> result <- lm(y1~x1+x2+x3)

> vif(result)

x1 x2 x3

3.607546 1.975832 5.010688

>

결과해석- x1의 VIF: 3.607546

- x2의 VIF: 1.975832

- x3의 VIF: 5.010688

- VIF가 10이 넘지 않으므로 다중공선성은 없는 것으로 판단된다.

[edit]

10 회귀진단 #

잔차는..

- 정규분포를 따라야하고,

- 분산이 일정하고,

- 특별한 추세를 보이지 않아야 한다.

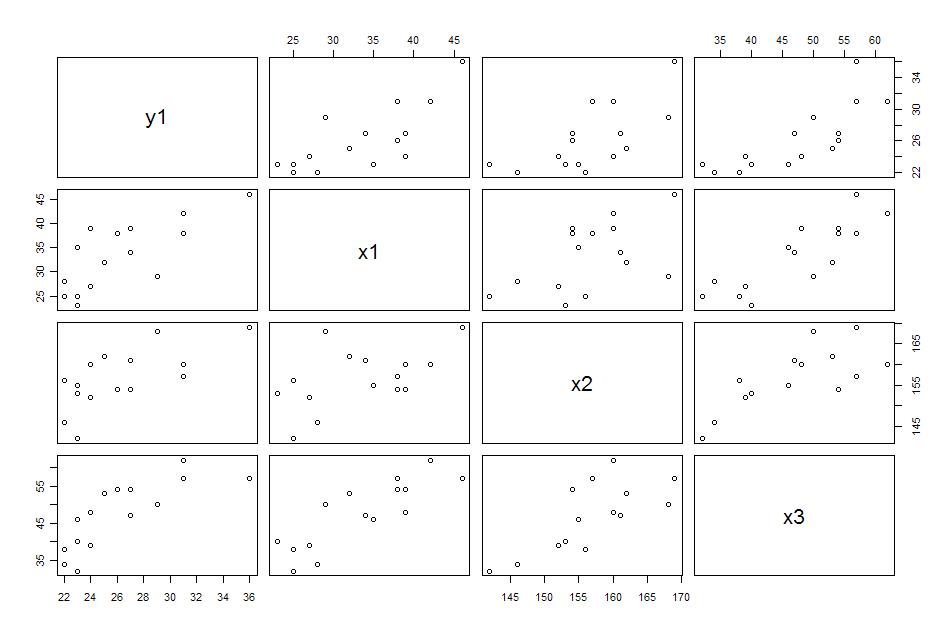

par(mfrow=c(2,2)) plot(lm(formula = y1 ~ x1 + x2 + x3 + x1:x2))

- 좌상: 예측값, 잔차 --> 0으로부터 고르게 분포하고 있는가?

- 우상: 표준화된 잔차의 Q-Q Plot --> 정규성을 띄는가?

- 좌하: 예측값, 스튜던트 잔차(표준화된 잔차)의 제곱근 --> 직선에 가까워야 한다.. 분산이 일정하지 않음을 의심해야 함.

- 우하: 레버러지와 스튜던트 잔차 plot --> rs = (k + 1 / n) * 2; k = predictor의 숫자, n = sample_size; rs보다 크가면 outlier

> out <- lm(formula = y1 ~ x1 + x2 + x3 + x1:x2)

> shapiro.test(resid(out))

Shapiro-Wilk normality test

data: resid(out)

W = 0.9669, p-value = 0.8099

>

결과에서 볼 수 있듯이 p-value = 0.8099로 '정규분포와 차이가 없다'라는 귀무가설을 조낸 지지한다. 즉, 잔차는 정규분포를 따른다.등분산성

브로슈-파간 테스트(Breusch- Pagan Test)로 등분산인지 알아본다.

브로슈-파간 테스트(Breusch- Pagan Test)로 등분산인지 알아본다.

> library("lmtest")

> bptest(out)

studentized Breusch-Pagan test

data: out

BP = 5.6201, df = 4, p-value = 0.2294

>

p-value가 0.2294로 유의수준 0.05에서 귀무가설 지지한다. 즉, 등분산이다. 만약 이분산(heterogenous variance)일 경우 가중최소제곱(weighted least squares; nls()사용)의 사용. 변수변환을 통해 교정할 수도 있다. > out <- lm(formula = y1 ~ x1 + x2 + x3 + x1:x2, weights=I(x1^(2)))

> summary(out)

Call:

lm(formula = y1 ~ x1 + x2 + x3 + x1:x2, weights = I(x1^(2)))

Residuals:

Min 1Q Median 3Q Max

-106.194 -34.272 4.358 30.456 85.645

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 206.98239 62.41049 3.316 0.00779 **

x1 -6.74461 1.84209 -3.661 0.00438 **

x2 -1.25865 0.40492 -3.108 0.01109 *

x3 0.44112 0.13692 3.222 0.00915 **

x1:x2 0.04199 0.01105 3.800 0.00349 **

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 61.32 on 10 degrees of freedom

Multiple R-squared: 0.8834, Adjusted R-squared: 0.8368

F-statistic: 18.94 on 4 and 10 DF, p-value: 0.0001167

독립성

> library("lmtest")

> dwtest(out)

Durbin-Watson test

data: out

DW = 2.3524, p-value = 0.7083

alternative hypothesis: true autocorrelation is greater than 0

>

- d통계량

- 0 : 양의 자기상관, p-value = 1

- 2 : 독립, p-value = 0

- 4 : 음의 자기상관, p-value = -1

- 0 : 양의 자기상관, p-value = 1

- 대략적으로 DW값이 1보다 작거나 3보다 크면 자기상관이 확실히 있다고 판달할 수 있으며, 1.5~2.5 사이에 있을 경우 독립이라고 판단

- 대략 독립.

[edit]

11 두 회귀식의 비교 #

data(airquality) lm1<-lm(Ozone~.,airquality) # full model lm2<-lm(Ozone~Solar.R+Wind +Month+Day,airquality) # reduced model anova(lm2,lm1)

[edit]

12 다변량 회귀분석 #

여기에서는 그냥 lm()함수의 다변량 회귀분석의 사용방법만 보자.

y2 <- x1 #x1을 종속변수라 가정하고...

summary(lm(cbind(y1,y2)~x2+x3))

> y2 <- x1

> summary(lm(cbind(y1,y2)~x2+x3))

Response y1 :

Call:

lm(formula = y1 ~ x2 + x3)

Residuals:

Min 1Q Median 3Q Max

-3.5060 -1.5862 0.2502 0.8539 5.3777

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -9.8745 17.4765 -0.565 0.5825

x2 0.1493 0.1311 1.139 0.2770

x3 0.2678 0.1043 2.567 0.0247 *

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 2.552 on 12 degrees of freedom

Multiple R-squared: 0.6578, Adjusted R-squared: 0.6008

F-statistic: 11.53 on 2 and 12 DF, p-value: 0.001605

Response y2 :

Call:

lm(formula = y2 ~ x2 + x3)

Residuals:

Min 1Q Median 3Q Max

-5.4716 -1.9151 -0.2964 1.9562 7.1935

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 16.5997 27.1675 0.611 0.552589

x2 -0.1079 0.2038 -0.529 0.606186

x3 0.7095 0.1622 4.375 0.000904 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 3.967 on 12 degrees of freedom

Multiple R-squared: 0.7228, Adjusted R-squared: 0.6766

F-statistic: 15.65 on 2 and 12 DF, p-value: 0.0004537

>

[edit]

13 결과의 해석 #

뭘 또 이렇게까지나 해야 하는지?? 안 해도 되는거 같으다.

> summary(model)

Call:

lm(formula = 통계 ~ 수학 + 결석, data = result)

Residuals:

Min 1Q Median 3Q Max

-5.348 -2.274 -1.276 2.954 5.673

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 53.6832 14.1808 3.786 0.00431 **

수학 0.6073 0.1984 3.062 0.01353 *

결석 -1.9346 0.9144 -2.116 0.06348 .

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 3.721 on 9 degrees of freedom

Multiple R-squared: 0.8289, Adjusted R-squared: 0.7909

F-statistic: 21.8 on 2 and 9 DF, p-value: 0.0003544

- 회귀직선이 y=통계, x1=수학, x2=결석 이라면, y = 53.6832 + 0.6073x1 + -1.9346x2 으로 추정된다.

- -1.9346x2으로 마이너스(-)값을 가진다는 것은 결석을 할 수록 통계성적이 나빠진다는 것을 의미한다.

- 'β1=0'이라는 귀무가설에 대한 T 검정통계량은 3.062이며, 이것은 P값은 0.01353으로 유의수준 0.05에서는 귀무가설을 기각하게 된다. 즉, 유의미한 값이다.

- 결정계수 R2은 아래의 anova(분산분석)의 결과에서 R2 = (541.69 + 61.97)/(541.69 + 61.97 + 124.59) = 0.8289186405이고, 조정된 R2값은 0.7909 이다. 즉, 통계성적은 수학성적과 결석횟수 2개의 변수에 의해 약 83%가 설명되어진다.

- F 검정통계량은 21.8이며, F분포표의 α = 0.05, v1=2, v2=9의 값은 4.26이다. 즉, 21.8 > 4.26 이므로 귀무가설(β1=β2=0)은 기각한다. 즉, 유의미한 값이다. p-value가 나오므로 F분포표를 볼 필요는 없다. 유의수준 0.05 > 0.0003544 이므로 귀무가설을 기각하면 된다.

- p-value가 작으면 대립가설을 지지하고, 커지면 귀무가설을 지지한다. 0.0003544는 귀무가설이 맞다고 가정했을 경우 얻어진 검정통계량보다 더 극단적인 결과가 나올 확률이다. 즉, 통계적인 수치에 근거하여 의사결정을 했을 때에 오류(1종 오류)가 나올 확률.

- 유의수준 0.05라는 것은 95%만 평균에 가까운 정상으로 생각하고, 평균가 멀리 떨어진 5%는 비정상으로 생각한다는 것이다.

> anova(model) #자유도, 제곱합, 제곱평균 F값,

Analysis of Variance Table

Response: 통계

Df Sum Sq Mean Sq F value Pr(>F)

수학 1 541.69 541.69 39.1297 0.0001487 ***

결석 1 61.97 61.97 4.4762 0.0634803 .

Residuals 9 124.59 13.84

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

| 요인 | 제곱합 | 자유도 | 제곱평균 | F비 |

| 회귀 | 603.66 | 11 | 301.83 | 21.802950 |

| 잔차 | 124.59 | 9 | 13.84 | |

| 계 | 728.25 | 11 |

- F 검정통계량은 21.8이며, F분포표의 α = 0.05, v1=2, v2=9의 값은 4.26이다. 즉, 21.8 > 4.26 이므로 귀무가설(β1=β2=0)은 기각한다. 즉, 유의미한 값이다.

- 결정계수 R2은 아래의 R2 = 603.66/728.25 = 0.82891864 이다.

- 자유도란 자유로운 정도. 랜덤한 정도. 수식에 의해 자유가 제한되지 않는 정도인데 보통 표본의 개수를 의미한다.

fit <- lm(Volume ~ Girth + Height, data=trees) f <- summary(fit)$fstatistic pf(f[1],f[2],f[3],lower.tail=F)

참고: 95% 신뢰구간

confint(model, level=0.95)

2.5 % 97.5 %

(Intercept) 502.5676 524.66261

poly(q, 3)1 1919.2739 2232.52494

poly(q, 3)2 -264.6292 48.62188

poly(q, 3)3 707.3999 1020.65097

[edit]

14 표준화된 회귀계수(beta) #

- B : 비표준화 회귀계수

- beta : 표준화 회귀계수

model <- lm(Girth ~ Height + Volume, data=trees) summary(model)

결과

> summary(model)

Call:

lm(formula = Girth ~ Height + Volume, data = trees)

Residuals:

Min 1Q Median 3Q Max

-1.34288 -0.56696 -0.08628 0.80283 1.11642

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 10.81637 1.97320 5.482 7.45e-06 ***

Height -0.04548 0.02826 -1.609 0.119

Volume 0.19518 0.01096 17.816 < 2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.7904 on 28 degrees of freedom

Multiple R-squared: 0.9408, Adjusted R-squared: 0.9366

F-statistic: 222.5 on 2 and 28 DF, p-value: < 2.2e-16

각각의 계수(B)는 나오는데, 어떤 변수가 더 큰 영향을 끼치는지 알 수 없다.

이런 경우 beta를 보면되는데, lm결과에 나오지 않는다. 다음과 같이 하면 된다.

이런 경우 beta를 보면되는데, lm결과에 나오지 않는다. 다음과 같이 하면 된다.

#install.packages("QuantPsyc")

library("QuantPsyc")

lm.beta(model)

결과

> lm.beta(model)

Height Volume

-0.09235166 1.02236871

Volume이 거의 모든 영향을 끼쳤다. 물론 beta를 보기 전에 Height 변수는 모델에서 제거 되었을 것이다.[edit]

15 predict #

y <- seq(1: nrow(x1)) dau <- x1$dau fit <- lm(dau ~ poly(y, 3)) summary(fit) plot(dau~y) lines(y, predict(fit, data.frame(y=y)), col="purple") newdata <- data.frame(y = seq(139,145)) predict(fit, newdata) out <- lm(dau~y + I(y^2) + I(y^3)) summary(out) p <- 145 3.131e+06 - p*2.637e+04 + (p^2) * 2.438e+02 - (p^3)*1.138e+00

[edit]

16 마우스로 콕콕 찝어서 이상치 제거 후 회귀분석하기 #

plot(y ~ x, data=df) notin <- identify(df$x, df$y, labels=row.names(df)) fit <- lm(y ~ x - 1, data=df[!rownames(df) %in% notin,]) summary(fit) plot(y ~ x, data=df[!rownames(df) %in% notin,]) abline(fit)

[edit]

17 coef의 신뢰구간 #

se <- sqrt(diag(vcov(bu.model)))[2] ci.upr <- coef(bu.model)[2] + 1.96*se ci.lwr <- coef(bu.model)[2] - 1.96*se

[edit]

18 confidence, prediction level #

- interval = "confidence"는 평균적인 것, 즉, 오차항(intercept)을 고려치 않아(0으로 가정) 범위가 prediction에 비해 좁다.

- interval = "prediction"은 single value에 대한 것, 즉, 오차항(intercept)가 고려해야 함

# Make up some data x <- seq(0, 1, length.out = 20) y <- x^2 + rnorm(20) # fit a quadratic model <- lm(y ~ I(x^2)) fitted <- predict(model, interval = "confidence", level=.95) # plot the data and the fitted line plot(x, y) lines(x, fitted[, "fit"]) # now the confidence bands lines(x, fitted[, "lwr"], lty = "dotted") lines(x, fitted[, "upr"], lty = "dotted")

[edit]

19 R-squared #

R^2의 의미

- 회귀식이 설명하는 변동량

- 실제값과 예측값의 상관관계(R^2는 피어슨 상관계수의 제곱)

d <- data.frame(y=(1:10)^2,x=1:10) model <- lm(y~x,data=d) d$prediction <- predict(model,newdata=d) #R-squared 1-sum((d$prediction-d$y)^2)/sum((mean(d$y)- d$y)^2)

독립변수가 많아지면 R^2가 커지는 경향이 있다. 그래서 조정된 R^2를 사용한다.

여러 독립변수를 사용한 회귀식간의 비교는 조정된 R^2로 비교해야 한다.

조정된 R^2은 다음과 같이 구한다.

여러 독립변수를 사용한 회귀식간의 비교는 조정된 R^2로 비교해야 한다.

조정된 R^2은 다음과 같이 구한다.

m <- lm(Girth~Height, trees) summary(m)

> summary(m)

Call:

lm(formula = Girth ~ Height, data = trees)

Residuals:

Min 1Q Median 3Q Max

-4.2386 -1.9205 -0.0714 2.7450 4.5384

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -6.18839 5.96020 -1.038 0.30772

Height 0.25575 0.07816 3.272 0.00276 **

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 2.728 on 29 degrees of freedom

Multiple R-squared: 0.2697, Adjusted R-squared: 0.2445

F-statistic: 10.71 on 1 and 29 DF, p-value: 0.002758

[edit]

20 Adjusted R-squared #

n <- length(trees$Girth) #표본수 p <- 1 #독립변수수 R2 <- cor(trees$Girth, fitted(m))^2 #R-squared 1 - ((n-1)*(1-R2)/(n-p-1)) #Adjusted R-squared

[edit]

21 as.lm.nls #

as.lm.nls <- function(object, ...) {

if (!inherits(object, "nls")) {

w <- paste("expected object of class nls but got object of class:",

paste(class(object), collapse = " "))

warning(w)

}

gradient <- object$m$gradient()

if (is.null(colnames(gradient))) {

colnames(gradient) <- names(object$m$getPars())

}

response.name <- if (length(formula(object)) == 2) "0" else

as.character(formula(object)[[2]])

lhs <- object$m$lhs()

L <- data.frame(lhs, gradient)

names(L)[1] <- response.name

fo <- sprintf("%s ~ %s - 1", response.name,

paste(colnames(gradient), collapse = "+"))

fo <- as.formula(fo, env = as.proto.list(L))

do.call("lm", list(fo, offset = substitute(fitted(object))))

}

predict(as.lm.nls(fit), data.frame(x=xx), interval="prediction", level=.99)

[edit]

22 비모수 방법 #

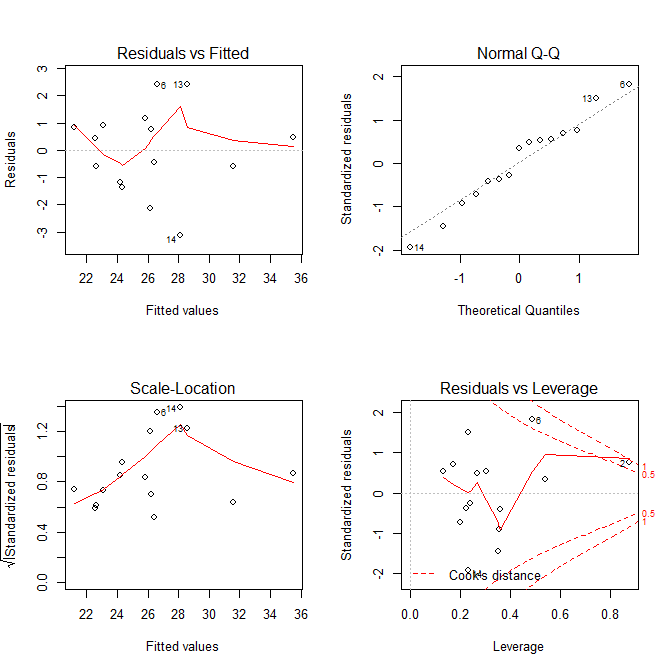

x <- c(3,4,5,6,7)

y <- c(4.8, 6, 7.2, 7.8, 8.2)

fit1 <- lm(y ~ x)

summary(fit1)

plot(x,y)

abline(fit1)

library("zyp")

fit2 <- zyp.sen(y ~ x)

fit2

abline(coef=coef(fit2), col="red")

--빨간선이 비모수 방법

[edit]

23 오차 계산 #

이거 은근히 귀찮은데, 역시 만들어 놨군.

y <- c(4.17,5.58,5.18,6.11,4.50,4.61,5.17,4.53,5.33,5.14)

x <- c(4.81,4.17,4.41,3.59,5.87,3.83,6.03,4.89,4.32,4.69)

model <- lm(y ~ x)

library("DMwR")

regr.eval(y, fitted(model))

plot(x,y)

abline(model)

> regr.eval(y, fitted(model)) mae mse rmse mape 0.41276110 0.24190200 0.49183534 0.08399855

[edit]

24 t-sql로 구현한 단순회귀분석 #

select

(count(*)*sum(x*y)-(sum(x)*sum(y)))/(count(*)*sum(x*x)-(sum(x)*sum(x))) slope

, avg(y)-((count(*)*sum(x*y))-(sum(x)*sum(y)))/((count(*)*sum(power(x,2)))-power(sum(x),2))*avg(x) intercept

from tbl_xy

create view v_test

as

select 98 x, 1 y union all

select 90, 2 union all

select 90, 3 union all

select 65, 4 union all

select 66, 5 union all

select 67, 6 union all

select 13, 7 union all

select 44, 8 union all

select 27, 9

go

declare

@x nvarchar(255)

, @y nvarchar(255)

, @tablenm nvarchar(255)

, @where nvarchar(1000)

, @a nvarchar(255)

, @b nvarchar(255)

, @sql nvarchar(max);

set @x = 'x';

set @y = 'y';

set @tablenm = 'select * from v_test';

set @where = '';

set @sql = '

declare

@cnt int

, @a decimal(38,5)

, @b decimal(38,5)

, @c decimal(38,5)

, @d decimal(38,5)

, @xavg decimal(38,5)

, @yavg decimal(38,5)

, @a1 decimal(38,5)

, @b1 decimal(38,5);

select

@cnt = count(*)

, @a = sum(convert(decimal(38,5), ' + @x + '))

, @b = sum(convert(decimal(38,5), ' + @y + '))

, @c = sum(convert(decimal(38,5), power(' + @x + ', 2)))

, @d = sum(convert(decimal(38,5), ' + @x + '*' + @y + '))

, @xavg = avg(convert(decimal(38,5), ' + @x + '))

, @yavg = avg(convert(decimal(38,5), ' + @y + '))

from (' + @tablenm + ') as t;

set @a1 = ((@b*@c) - (@a*@d)) / (@cnt*@c - power(@a, 2));

set @b1 = ((@cnt*@d) - (@a*@b)) / (@cnt*@c - power(@a, 2));

select

회귀식

, round(r2, 4) [R-squared]

, round(1-(1-r2)*(@cnt-1)/(@cnt-2),4) [Adjusted R-squared]

, round(corr, 4) 상관계수

from (

select

''y = ''+ convert(nvarchar, @a1) + '' + '' + convert(nvarchar, @b1) + ''x'' 회귀식

, 1 - var(' + @y + '-(@a1 + @b1*' + @x + ')) /

var(' + @y + ') r2

, ((1.00/(@cnt - 1)*sum((' + @x + '-@xavg) * (' + @y + '-@yavg))) /

sqrt(var(' + @x + ') * var(' + @y + '))) corr

from (' + @tablenm + ') as t

where 1=1 ' + @where + '

) t

select

row_number() over(order by ' + @x + ') seq

, ' + @x + ' x

, ' + @y + ' y

, power(' + @x + ', 2) x2

, ' + @x + '*' + @y + ' xy

, @a1 + @b1*' + @x + ' estimatedvalue_linear

--, @a1 * log(@a) + @b1 *' + @x + ' estimatedvalue_log

, ' + @y + '-(@a1 + @b1*' + @x + ') diffvalue

from (' + @tablenm + ') as t

where 1=1 ' + @where + '

order by 2;

';

print @sql;

exec(@sql);

![[-] [-]](/moniwiki/imgs/plugin/arrup.png)

![[+] [+]](/moniwiki/imgs/plugin/arrdown.png)

![[https]](/moniwiki/imgs/https.png)